Discounted future cash flow calculator

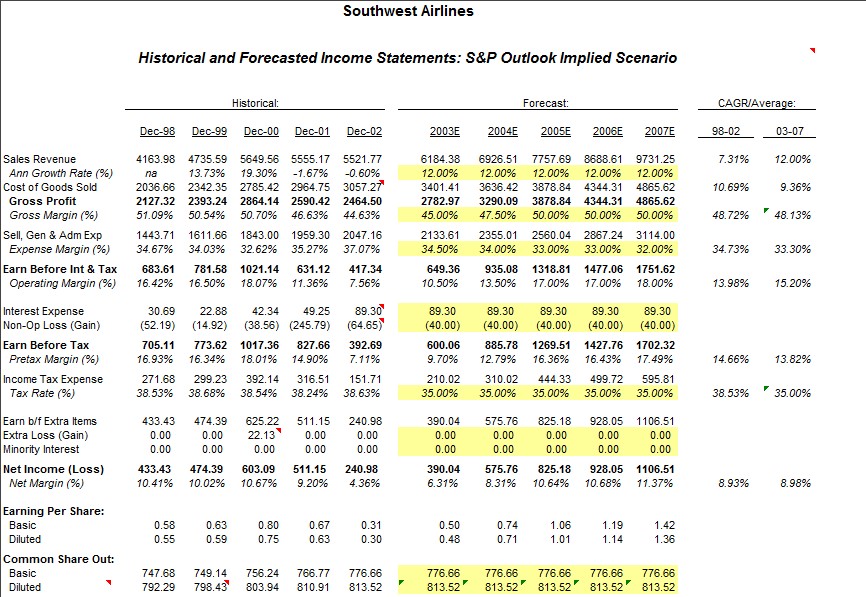

If our total number of periods is N the equation for the future value of the cash flow series is the summation of individual cash flows. How Do You Calculate Discounted Cash Flow From Npv.

Discounted Cash Flow Calculator Dcf

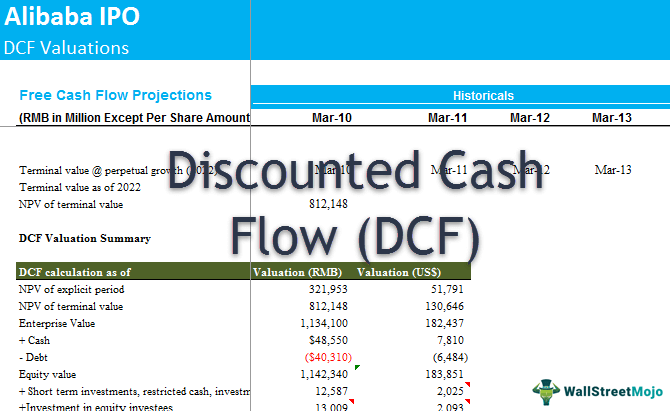

Discounted cash flow DCF is a valuation method used to estimate the attractiveness of an investment opportunity.

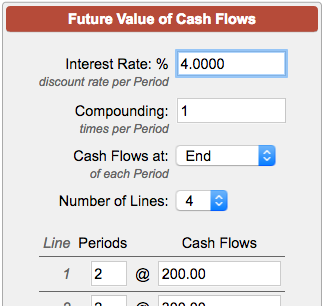

. F V n C F n 1 i n n. 1r 1 1r 2 1r n. The discounted cash flow calculation can be straightforward or complicated depending on the elements it contains.

Discounted Cash Flow Calculator. As long as you know what the expected future cash flows are. DCF CF1 CF2.

Business Valuation - Discounted Cash Flow Calculator. If an investor were to pay less than this amount the rate of return would be higher than the. With the Discounted Cash Flow analysis the value of the company is 209 billion.

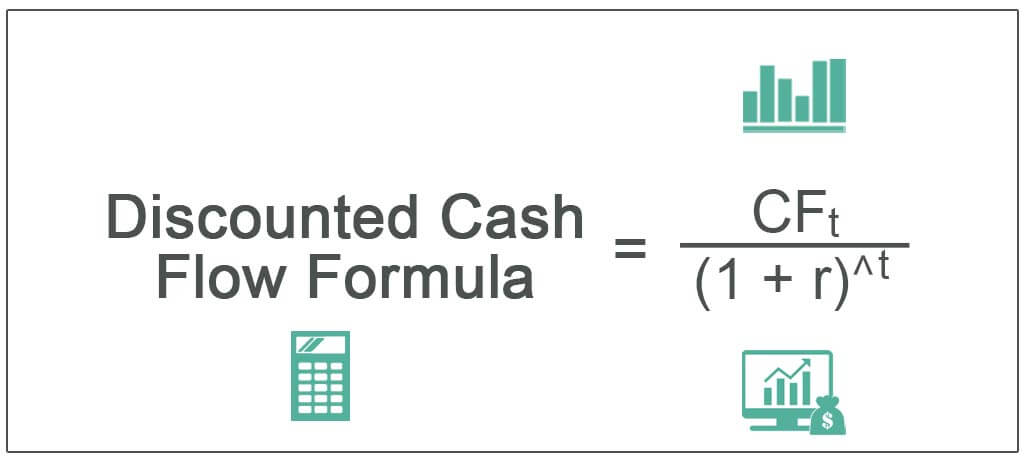

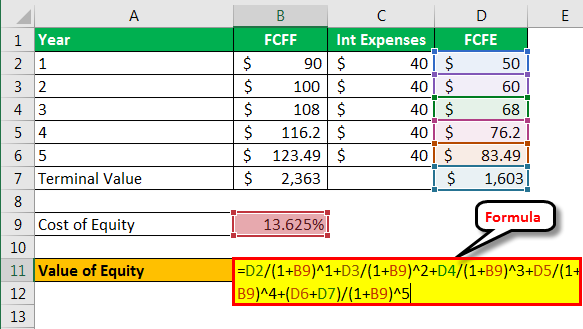

Calculation of Discounted Cash Flow DCF DCF analysis takes into consideration the time value of money in a compounding setting. The discounted cash flow DCF formula is equal to the sum of the cash flow in each period divided by one plus the discount rate WACC raised to the power of the period. Substituting cash flow for time period n CFn for FV interest rate for the same period i n we calculate present value for the cash flow for that one period PVn P V n C F n 1 i n n.

Intrinsic value of future cash flows for a business stock investment house purchase. As an alternative to the more abbreviated income capitalization approach this methodology is more relevant where future operating conditions and cash flows are variable or not projected. The free cash flow calculator calculates the terminal value at the end of year 5 and the present value PV of the terminal cash flow today.

Initial FCF Rs Cr Take 3 Years average. The discounted cash flow formula uses a cash flow forecast for future years discounted back. NPV discount rate cash flow series NPV discount rate cash flow series NPV discount rate A discount rate of 33 should be.

Business valuation is typically based on three major methods. Heres our Discounted Cash Flow DCF Calculator for your ease of calculation so that you dont have to break your head in complicated excel sheets. The discounted cash flow DCF formula is.

The income approach the asset approach and the market comparable. However either way its always based on the following discounted cash. Discounted Cash-flow Model is a quantitative method that calculates a companys stock price based on the sum of all future free cash flow earned from that company at a discount rate.

After forecasting the future cash flows and. F V n 0 N C F n 1 i n N n. Discounted Cash Flow Template.

The discounted cash flow valuation. Business valuation BV is typically based on one of three methods. Use this simple easy-to-complete DCF template for valuing a company a project or an asset based on future cash flow.

DCF analyses use future free cash flow. The income approach the cost approach or the market comparable sales approach. Then once all future cash flows have been discounted to arrive at the net present value you then sum all discounted cash flows and subtract that amount from the original amount invested.

The discounted cash flow DCF model is probably the most versatile technique in the world of valuation. Our online Discounted Cash Flow calculator helps you calculate the Discounted Present Value aka.

Dcf Formula Calculate Fair Value Using Discounted Cash Flow Formula

Discounted Cash Flow Dcf How To Use It For Stock Valuation Getmoneyrich

Discounted Cash Flow Analysis Study Com

Cash Flow Valuation Part 4 Of How To Value A Small Business Genesis Law Firm

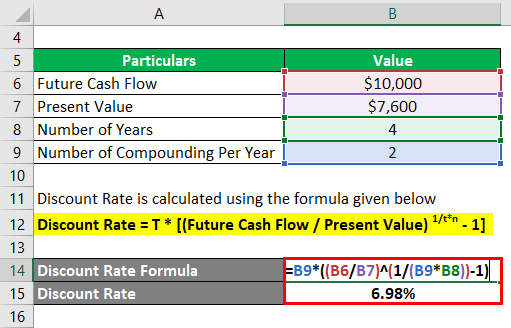

Discount Rate Formula How To Calculate Discount Rate With Examples

Discounted Cash Flow Calculator Calculate Dcf Of A Stock Business Investment

Discounted Cash Flow Dcf Formula Calculate Npv Cfi

Future Value Of Cash Flows Calculator

Discount Rate Formula How To Calculate Discount Rate With Examples

Discounted Cash Flow Dcf How To Use It For Stock Valuation Getmoneyrich

The Discounted Cash Flow Dcf Valuation Method Magnimetrics

Discounted Cash Flow Analysis Street Of Walls

Dcf Formula Calculate Fair Value Using Discounted Cash Flow Formula

Discounted Cash Flow Create Dcf Valuation Model 7 Steps

How To Use Discounted Cash Flow Time Value Of Money Concepts

Discounted Cash Flow Model Formula Example Interpretation Efm

How To Calculate Discounted Cash Flow For Your Small Business